extended child tax credit 2021

One bit of good news is that families who were receiving monthly Child Tax Credit payments can claim the remaining half of the 2021 Child Tax Credit by. Parents who filed taxes in 2019 andor 2020 and meet the income requirements started receiving advance Child Tax Credit payments on July.

Is The Enhanced Child Tax Credit Getting Extended This Year Here S The Latest Cnet

This means eligible families will receive 300 monthly for each child under 6 and 250 per child older than that.

. Fourth the credit has been extended to 17-year-olds for the first time that is children who turn 17 in 2021. Last March Democrats in Congress passed a bill extending the Child Tax Credit from July through the end of 2021. Filing a 2021 Federal tax return in 2022 will allow families eligible to claim the 2021 CTC to receive their remaining benefit.

53 Child care centers near Hicksville NY. Find help that fits your needs. 2000 in 2020 to 3600.

This benefit for families with children originated with a tax package Congress passed in 1997. For example a family eligible for full Child Tax Credits and with one five-year-old and one eight-year-old will receive 6600 for 2021. The 2021 temporary expansion of the Child Tax Credit CTC is unprecedented in its reach and is predicted to cut American child poverty by more than half.

When do you need care. File a free federal return now to claim your child tax credit. From 2000 in 2020 to 3000.

Haverstraw NY currently has 30 tax liens available as of January 17. The IRS is distributing half of the credit as an advance on 2021 taxes in six monthly installments worth 250 to 300 per child. Parents may qualify for the full child tax credit payments if they meet one of the following rules outlined by the IRS.

Find the perfect care to fit your needs. Lawmakers subsequently modified it several times often with bipartisan support. A-year payments up to 300child under age 6.

Most families who received advance CTC payments only received half of the value of their credit. Child care tax credit has been increased to 16000. Ad The new advance Child Tax Credit is based on your previously filed tax return.

Children age 6 through 17. Tax Liens List For Properties In And Near Haverstraw NY How do I check for Tax Liens and how do I buy Tax Liens in Haverstraw NY. File With Confidence Today.

Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in Haverstraw NY at tax lien auctions or online distressed asset. Not long after the expanded child tax credit was passed as part of the American Rescue Plan Act in the spring of 2021 Columbia Universitys Center on. Almost all households in the United States received payments of 250 per month for children aged 6 to 17 and 300 per month for kids under the age of 6 however the benefits were tapered off for wealthier families.

Its wonderful seeing our son going to get excited about. This is a change from. Third this years CTC is fully refundable.

Reviewed by Bri F Aug 2021 55 stars. The Biden administrations 19 billion COVID-19 relief bill which Congress passed in March 2021 included a single-year expansion of the child tax credit. Almost all middle-and low-income families with children are.

Children under age 6. Heres what else parents need to know. The next check is two days away but there arent many payments left.

An amazing staff with so much heart and caring mindset. Join free to get started. And 250child ages 6 to 17 for the rest of 2021.

Its possible you could be looking at another 1500 or 1800 for each qualifying child now for the child tax credit after you file a 2021 federal income tax return. 150000 in total earned income if. The American Rescue Plan made three temporary changes to the longstanding child tax credit program applicable for calendar year 2021 which includes the annual federal income tax filing season.

In 2021 the maximum child eligibility age is raised by one year to 17 and the maximum tax credit is increased from 2000 to 3600 for each child under 6 and 3000 for each child age 6 to 17. Answer Simple Questions About Your Life And We Do The Rest. No Tax Knowledge Needed.

Its a one-time-only deal but the AARP is pushing to extend. Ad TurboTax Makes It Easy To Get Your Taxes Done Right. The expanded CTC provides families with 3600 for every child in the household under the age of six and 3000 for every child between the ages of six and 17.

Automatic monthly payments instead of once-. On 2021 returns theres no longer an age cap or ceiling set at 64 or younger for workers to qualify for the earned income tax credit. The November 15 2021 deadline to use the tool has passed.

In prior years the maximum return for the credit was 1050 for one child or 2100 for two or more.

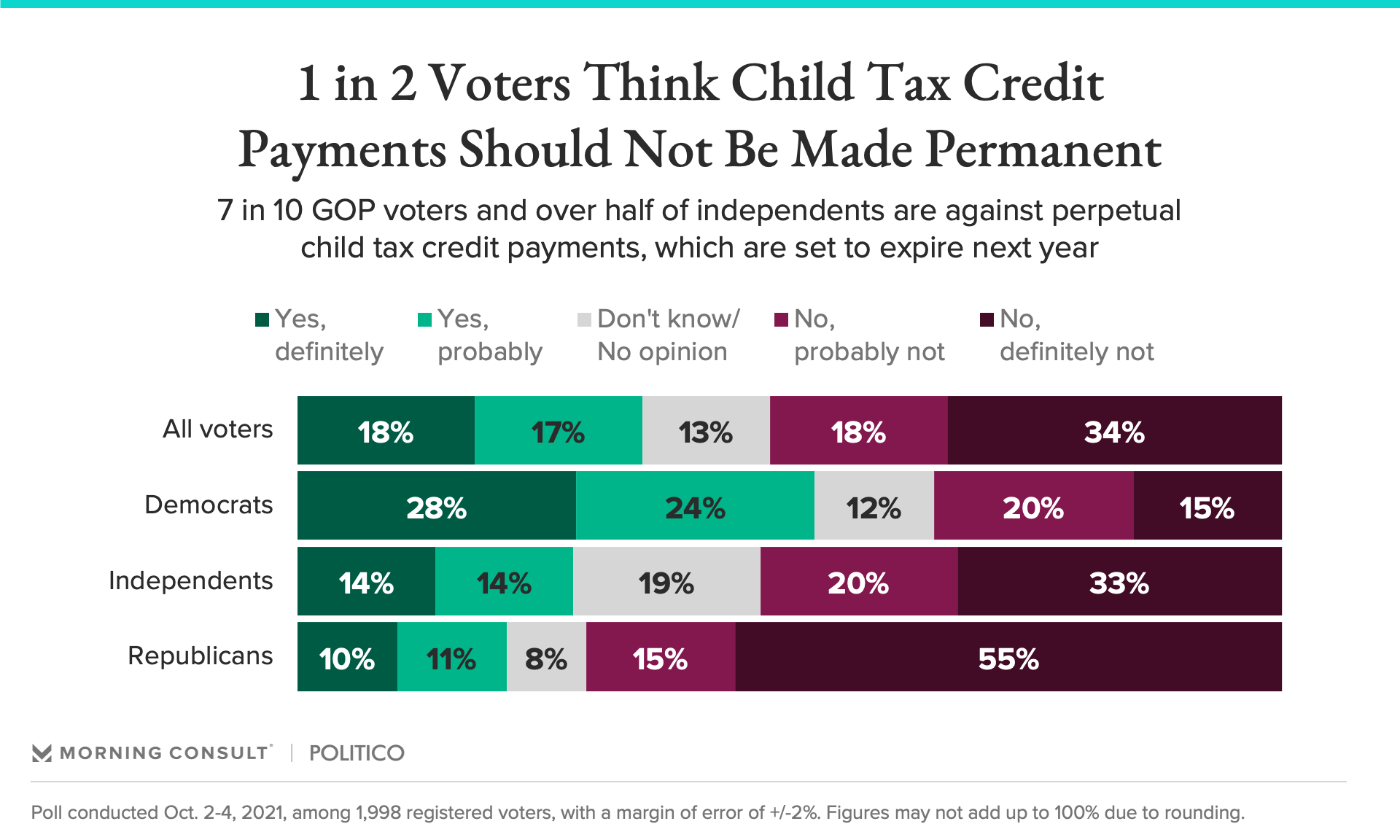

Who Gets Credit For The Expanded Child Tax Credits For Voters Across Parties Democrats And Biden Take The Prize

Why Biden S Expanded Child Tax Credit Isn T More Popular The New York Times

Child Tax Credit 2021 Payments How Much Dates And Opting Out Cbs News

Child Tax Credit 2021 2022 What To Know This Year And How To Claim Your Refund Wsj

Child Tax Credit United States Wikipedia

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

Child Tax Credit 2022 Could You Receive A Double Monthly Payment In February Marca

Why Biden S Expanded Child Tax Credit Isn T More Popular The New York Times

2021 Child Tax Credit Calculator How Much Could You Receive Abc News

Parents Guide To The Child Tax Credit Nextadvisor With Time

Details Of House Democrats Cash Payments And Tax Credit Expansions Itep

Payments From The Expanded Child Tax Credit Are Being Sent Out Npr

Child Tax Credit Ending Will Push 10 Million Kids Back Into Poverty

Taxes 2022 What Families Should Know About The Child Tax Credit Youtube

Child Tax Credit 2021 Joe Manchin Opposes Aid Parents Are Using For Food Rent Bloomberg

Explainer What Are The Child Tax Credits Democrats Are Battling Over Reuters

Benefits Of Expanding Child Tax Credit Outweigh Small Employment Effects Center On Budget And Policy Priorities

Is The Enhanced Child Tax Credit Getting Extended This Year Here S The Latest Cnet